BLOG

Forget everything you know about accepting credit cards.

4 min. read

Jul 10, 2020

If your business only accepts cash, checks, or electronic bank transfers, and you feel like credit cards aren’t something you can afford to accept, then you should probably unlearn what you know about credit card acceptance. We’ve got a surprise for you, and we think you’re going to like it.

There are two types of businesses, those that are the only game in town and can charge whatever they want without losing any customers; and then there is the vast majority of businesses with healthy competition that are striving to make doing business with them easier.

If your business is the first type, you can stop reading right here. Life is good! You don’t need to change a thing. You can go back to playing golf and hope that your business remains the only game in town for a very long time.

However, if you’re a business with competition and you want to win your customers’ loyalty for the long haul, then there is something you can do today and we are 100% certain you can afford it.

Research shows that over 75% of customers find it extremely difficult to always have enough cash in their bank account to pay their vendors. They often miss out on opportunities while waiting for cash to free up so they can buy new inventory or materials for the next project or client. Vendors’ unwillingness to accept credit cards stifles their growth and hurts everybody in the process.

There are good reasons why many vendors still don’t accept credit cards. Traditional card acceptance solutions come with a number of disadvantages. First is the high cost of card acceptance, with fees ranging between 2.75% and 5% of your sales amount. Then there’s the time lag between processing a credit card and money being deposited into your bank account. There may be a withholding of funds to cover potential fraud. And if you take cards over the phone or via email, you are on your own protecting your customers sensitive card information against theft and misuse.

The sad reality is, traditional card acceptance providers aren’t really trying to address these issues. They’re making hundreds of millions in profits off transaction fees and have no incentive to change the status quo.

But it has created a trillion dollar problem for customers, and it hurts your business too.

Every growing business needs access to more working capital. It allows them to fulfill new orders when their cash is still tied up in prior projects. Too often that access to additional working capital makes the difference between a growing business and a struggling one.

Very few businesses are able to get a loan or a line of credit as a form of additional working capital that they can use when their cash is tied up. Yet almost all have a credit card with which they bridge the 30, 45 or 60 days until they get paid in turn. Instead of forfeiting opportunities for the 30, 45 or 60 days, they can use their credit cards to fulfill them. That is why millions of businesses depend on vendors and suppliers who accept cards.

We started Plastiq because we saw the need first hand and because we knew there was a better way. We thought that in the age of private rocket launches, there must be a way to make universal credit card acceptance free, fast, easy, and available to any business in a secure, convenient, and affordable way.

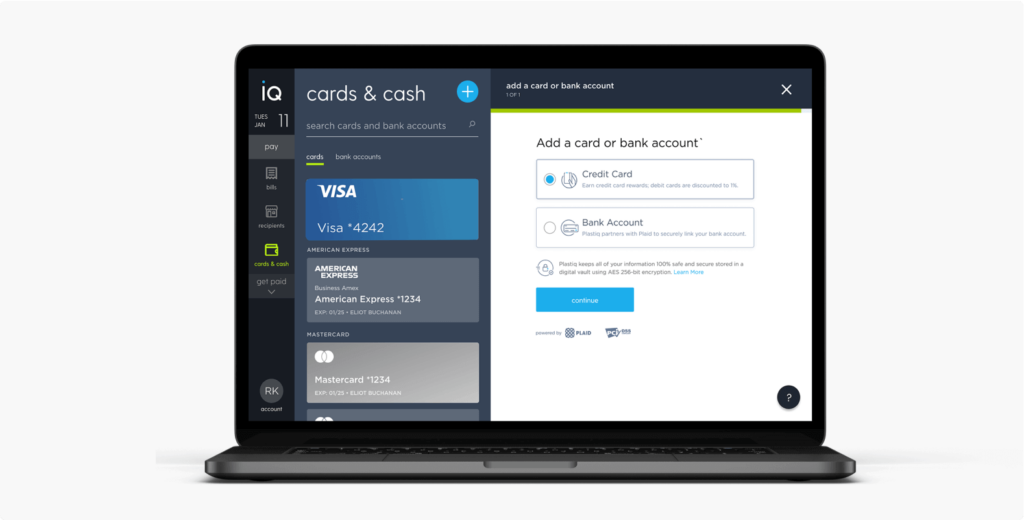

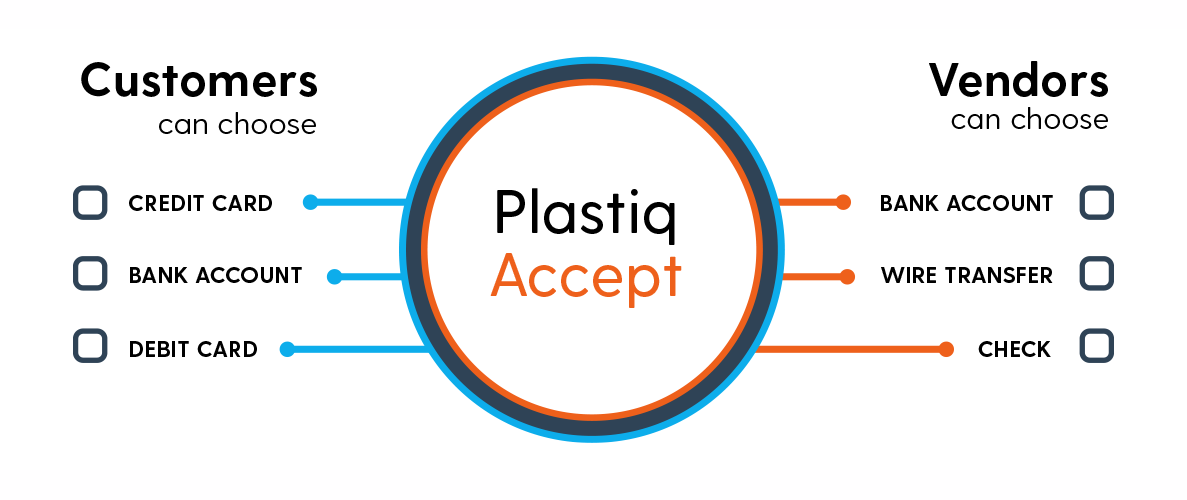

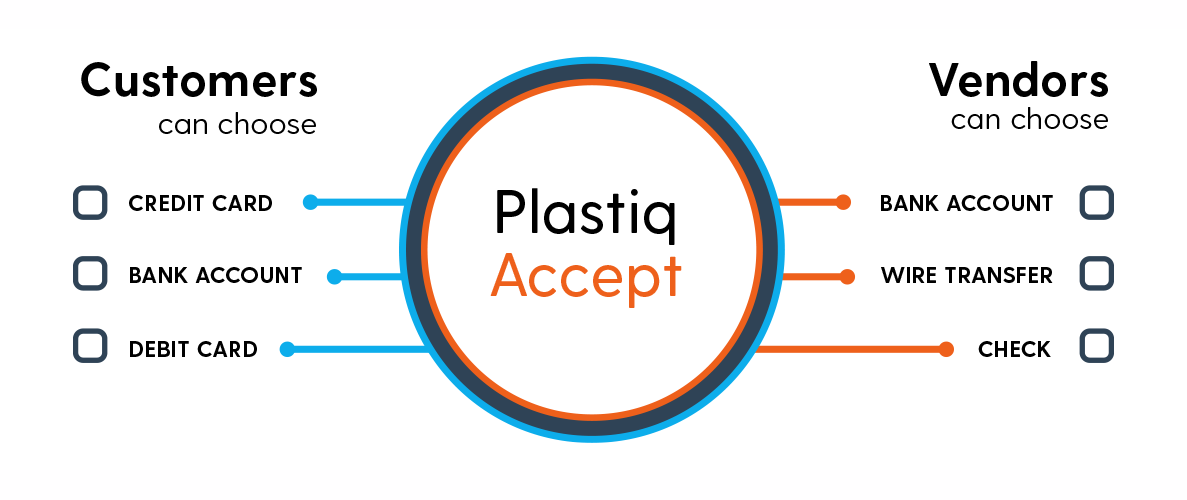

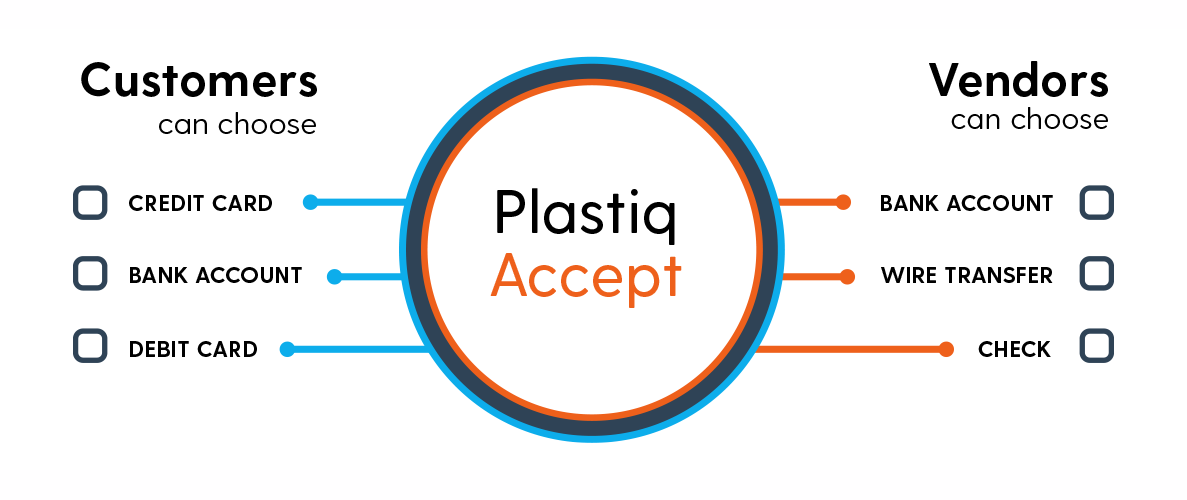

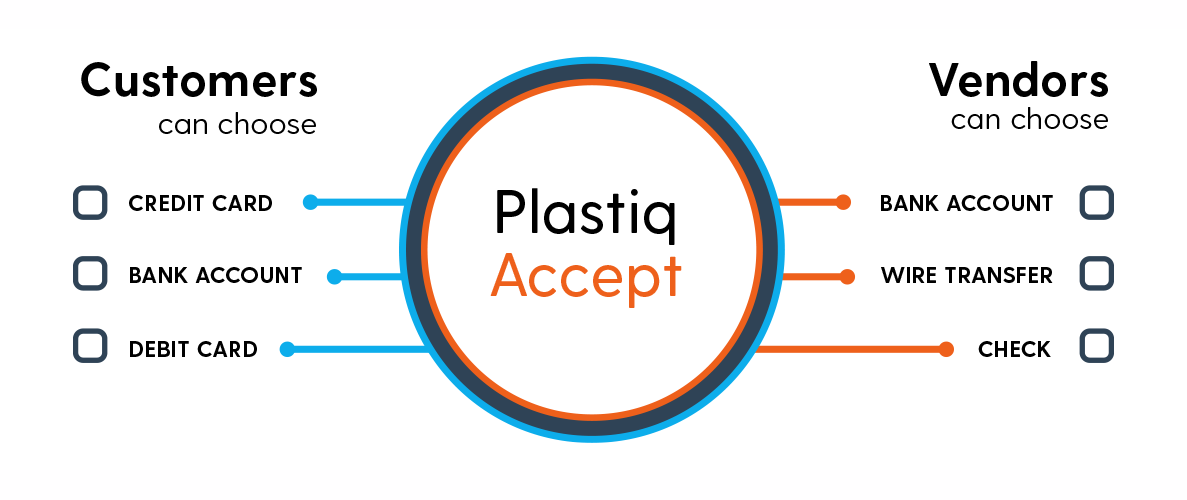

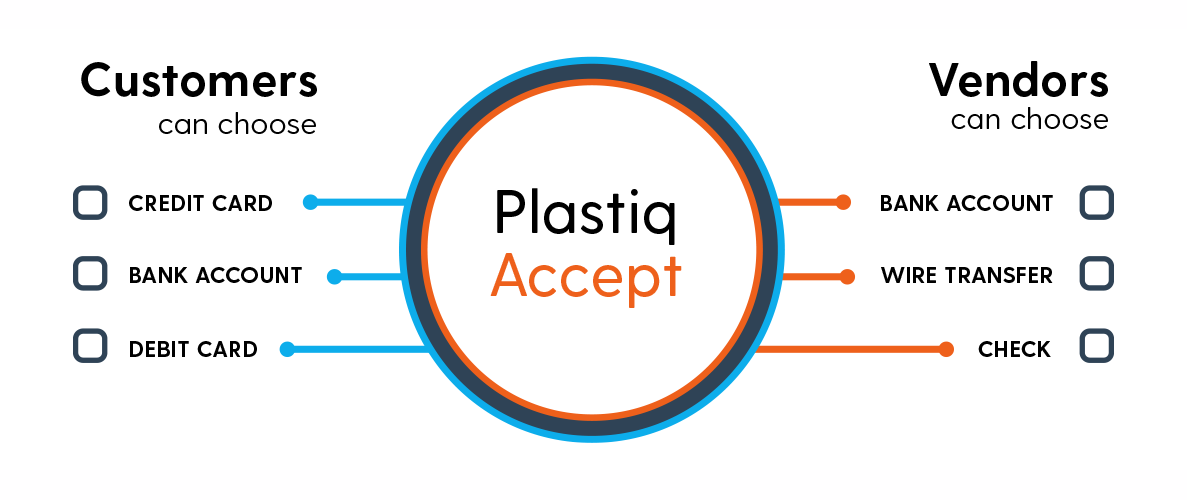

We made things so flexible and simple, that both you and your customer can now choose how to pay and how to receive payments independently from one another. Everyone makes the best decision for them and walks away satisfied. You no longer have to dictate to your clients how they shall pay you just because you find card acceptance expensive and risky. Plastiq lets you receive your payment the way you want it—almost instantly via a bank transfer or wire.

That’s why we built Plastiq Accept—a totally new, all-in-one payment acceptance solution for businesses like yours who have stayed away from traditional card acceptance, but who realize the benefits to their customers, especially in times like these. The best part about Plastiq Accept is that it is free for you to use. You don’t need to pay anything to start accepting credit cards. Your customers pay Plastiq a small fee for the convenience of using their credit cards. You never have to wait for your money to be deposited—typically within a business day or two. Even payment risk concerns become a thing of the past through our built in risk-monitoring system. You simply let your clients pay the way they want, and you get paid the way you want—free, fast and easy.

Plastic Accept takes only 5 minutes to set-up. There’s no obligation to use it and no cancelation fees. In fact, there are no fees of any kind for you, period. You can send a payment link to your customers right away and they can pay you with their card if they want to.

So which type of business are you? The kind that needs to always get better and compete? Or are you the only only game in town? If you’re the former, check out Plastiq Accept and get an edge over your competition. If you’re the latter? Well, remember that a lot of businesses became the only game in town because they adopted solutions that their customers needed, even when the problem seemed intractable in the past. It’s the essence of innovation.

Sign up now

Stay up to date!

Don't miss out on new features, announcements, and industry trends by subscribing to our newsletter.