Payments

Deep Dive: Manufacturing

The shape of payments in the manufacturing industry today.

The manufacturing industry generates the largest volume of B2B payments, totaling $3.5T worldwide. In the US alone, there are ~592,000 manufacturing firms, with the majority of these firms being small with fewer than 20 employees.

54% of B2B orders are currently placed via self-service on websites. This is expected to significantly expand in the coming years as firms build e-commerce capabilities and embedded payments become more accessible to smaller firms. This trend will give rise to an opportunity to build out more efficient payment operations. Converting legacy payment systems to digital operations will shift the B2B supply chain from batch to real-time payments. The firms that are quickest to unlock value with real-time payments will have a significant competitive advantage.

Plastiq Accept can help your company make the conversion and seize the opportunity. Gain greater payment flexibility, payment tracking and increased customer choice.

Key Challenges

Manufacturing firms are facing some common challenges.

Payment

predictability

98% of B2B manufacturers receive payments late, while 16% experience detrimental impact to their cash flow.

Collection

friction

To survive future disruptions firms must pivot from manual invoicing to digital processes that are faster and more efficient.

Market

changes

Emerging trends and shifting preferences are causing B2B buyers to look for greater convenience & optimal margins.

Plastiq Accept Solutions

Plastiq Accept meets the challenges.

Predict your

payments

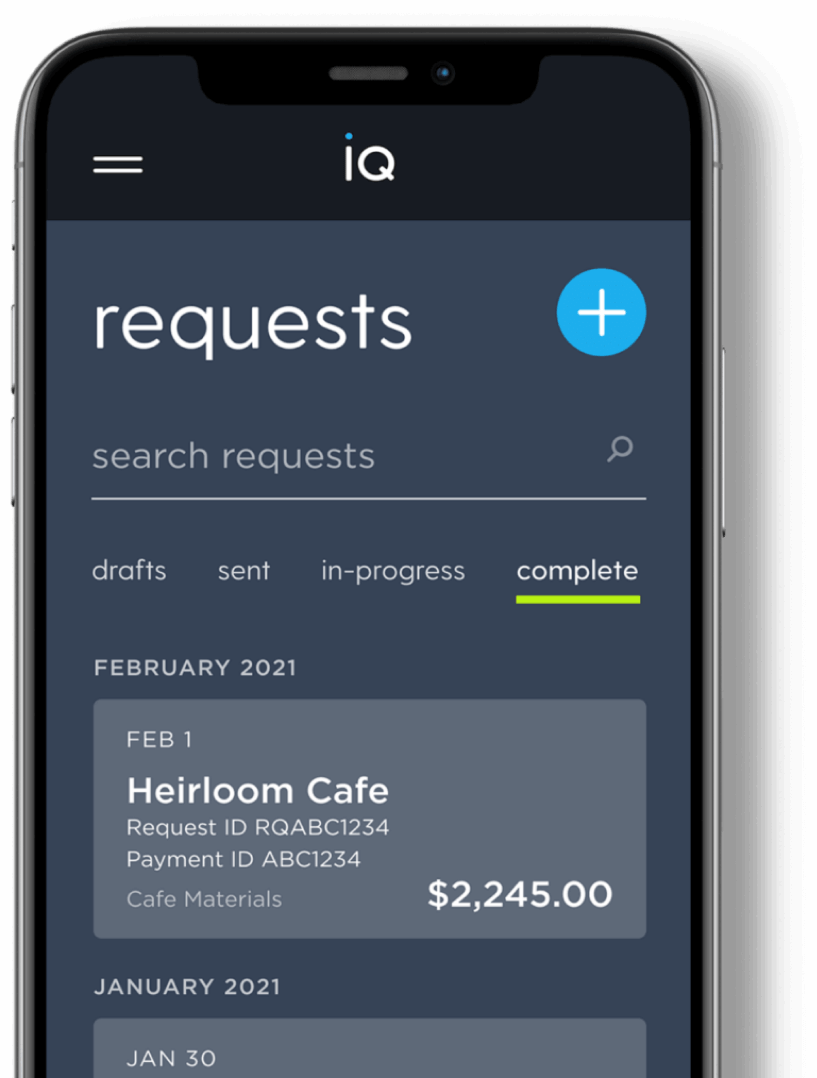

Plastiq Accept gives you end-to-end visibility into payment from request to delivery so you track and forecast your cash flow.

Streamline

payment collection

Plastiq Accept gives you the power to make real-time payment collection and gives your customers the freedom to pay you in multiple ways.

Resilient to

market changes

Plastiq Accept is convenient, user-friendly for businesses and customers, and built to anticipate emerging payment trends.

Plastiq Accept solves payment problems before they're problems.

Promotes real-time payment collection

Promotes real-time payment collection

Tracks open “unpaid” payment requests

Tracks open “unpaid” payment requests

Advanced reporting & real-time notifications

Advanced reporting & real-time notifications

End-to-end payment reports

End-to-end payment reports

Flexibility to adjust to payment challenges

Flexibility to adjust to payment challenges

Automated process shortens collection times

Automated process shortens collection times

More flexibility—offers multiple options

Offers more flexibility with multiple options

Enables card acceptance for budget-constrained SMBs

Enables card acceptance for budget-constrained SMBs

Use Plastiq Pay and

keep cash on hand

in your hands.

Plastiq Pay helps manufacturers preserve cash in the bank by leveraging the credit cards they have on hand. It’s much easier and less expensive compared to small business loans. Large expenditures for raw materials, supplies, and even payroll can be paid by credit card so that manufacturers can delay the time to pay off bills.

How Plastiq helped Solis labs increase profit and accelerate cash flow.

A manufacturing company, Solis Labs, was previously waiting for customers to mail in checks, often forced to wait weeks for cash flow. But, by adding Plastiq as a payment method for customers, they were able to accept credit cards without the fees which led to faster payments and increased profits. Read the case study.