Payments

Deep Dive: Wholesale

The shape of payments in wholesale today.

Wholesale trade is 5% of total global B2B payments. It is a complex, high volume and fiercely competitive industry. Since 2020 pandemic disruptions, demand for digital commerce sales channels grew dramatically and suppliers also sought channels with greater margin efficiency. Successful wholesalers are seeking innovative ways to offer a better customer experience and shift from batch to real-time payment processes. Today, 54% of B2B orders are now placed via self-service on company websites, with this predicted to grow to 80% by 2025.

Key Payment Challenges

Wholesale firms are facing some common challenges.

Manual

invoicing

Wholesalers generally engage in resource-intensive manual invoicing & payment processes, with an average DSO of 42-52 days.

Cash flow

predictability

Wholesalers often sell on account, deferring partial payment and delaying cash flow. Payment workflows are often fragmented & manual and offer limited visibility.

Low

margins

Margins have always been challenging for wholesalers, and suppliers are finding ways to avoid splitting margins by pivoting to a D2C model.

Plastiq Accept Solutions

Plastiq Accept meets the challenges.

Automated

receivables

Plastiq Accept automates payment collection within existing invoicing or checkout methods.

Faster inbound

payments

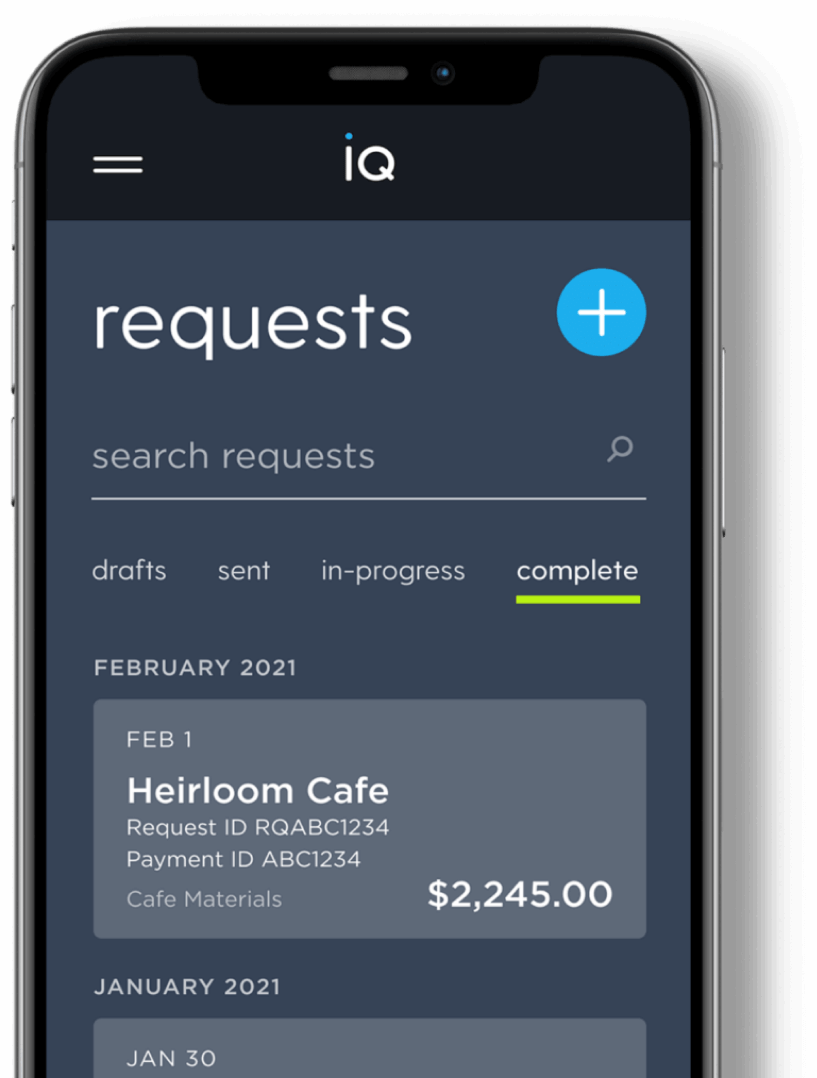

Plastiq Accept provides real-time payment collection and end-to-end payment tracking.

Improved

profit margins

Plastiq Accept does not charge businesses for card processing tech investments, keeping costs down.

Plastiq Accept solves payment problems before they're a problem.

Promotes real-time payment collection

Promotes real-time payment collection

Tracks open “unpaid” payment requests

Tracks open “unpaid” payment requests

Advanced reporting & real-time notifications

Advanced reporting & real-time notifications

End-to-end payment reports

End-to-end payment reports

Flexibility to adjust to payment challenges

Flexibility to adjust to payment challenges

Automated process shortens collection times

Automated process shortens collection times

Offers more flexibility with multiple options

More flexibility—offers multiple options

Enables card acceptance for budget-constrained SMBs

Enables card acceptance for budget-constrained SMBs

Use Plastiq Pay and

keep cash in your

hands.

As a wholesaler, you need to buy inventory from domestic & overseas suppliers. Plastiq Pay helps you preserve cash on hand so you can extend the time to pay your expenses closer to the time when merchandise will sell. With easy digital payments to pay suppliers & vendors in the U.S. and over 45 countries, Plastiq brings convenience, transparency, and automation to your outgoing payables.

Nandansons gets paid smarter withPlastiq Accept.

The challenge: Nandansons were looking for an end-to-end credit card solution for their buyer portal with a great customer experience to deepen their competitive edge and that could scale across their divisions.

The Plastiq Accept solution: Nandansons leveraged the Plastiq Accept Checkout SDK to embed payment capture in their ecommerce site with a single line of code. Now customers have the convenience of ordering & paying on the spot. Nandansons gets paid sooner and eliminates the manual work involved with chasing payments.